Buying property is a significant investment, and ensuring that the Title Deed Verification process is properly conducted is crucial to avoid legal disputes and financial losses. In Dubai, the Dubai Land Department (DLD) oversees property ownership records, making DLD Verification an essential step before purchasing real estate. Whether you’re looking to verify title deed Dubai or check title deed Dubai, this guide will walk you through the steps to ensure authenticity and safeguard your investment.

Why Title Deed Verification Is Important

Fraudulent property transactions can lead to severe consequences, including:

- Losing ownership rights due to fake or disputed deeds

- Legal disputes that can take years to resolve

- Financial losses from purchasing illegally transferred properties

- Difficulties in obtaining mortgages or selling the property in the future

To protect yourself, verifying the title deed before purchasing a property for sale in Dubai is essential.

Steps to Verify a Title Deed in Dubai

1. Check the Document’s Authenticity

Sift through the title deed and verify details such as:

- The property owner’s name

- The title deed number

- The property’s location and size

- Official DLD stamps and signatures

Ensure that the seller’s information matches the title deed to confirm legitimacy.

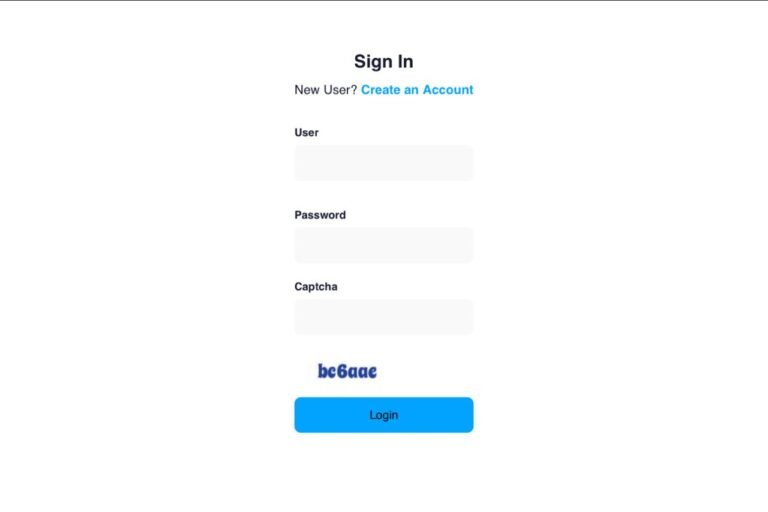

2. Use the DLD Verification System

The Dubai Land Department (DLD) provides an official online platform to check title deed Dubai records. You can verify ownership through:

- The DLD REST App (available for iOS and Android)

- The official Dubai Land Department website

- Visiting a DLD customer service center

This ensures that the title deed is legally registered and up to date.

3. Conduct a Physical Survey of the Property

Before buying any property for sale in Dubai, hire a licensed surveyor to confirm that the physical land or apartment matches the details on the title deed. Any discrepancies could indicate potential fraud or illegal modifications.

4. Check for Encumbrances and Liabilities

A title deed may have outstanding loans, mortgages, or legal disputes attached to it. Request an encumbrance certificate from the DLD Verification system to confirm if:

- The property is free from legal claims

- There are unpaid mortgages or financial liabilities

- Government acquisitions or development plans affect the property

If any encumbrances exist, clarify with the seller before proceeding.

5. Verify the Seller’s Legitimacy

Ensure that the person selling the property is the rightful owner. Ask for their Emirates ID and compare it with the details on the title deed. If an agent or representative is selling on behalf of the owner, verify the power of attorney with DLD.

6. Consult a Real Estate Lawyer

A property lawyer can help with Title Deed Verification by conducting due diligence, ensuring all legal documents are in order, and identifying potential red flags before the transaction is completed.

7. Obtain Certified Copies of the Deed

After completing the DLD Verification, request a certified copy of the title deed from the Dubai Land Department for official records.

Red Flags to Watch Out For

Be cautious if you encounter:

- Mismatched details in the title deed and DLD records

- Multiple ownership claims on the same property

- Missing or tampered official DLD stamps

- Sellers who rush the transaction or refuse verification

- Legal disputes or mortgages that aren’t disclosed

8. Verify Ownership History

Before purchasing a property, check its ownership history through the Dubai Land Department (DLD). This ensures that the property has not changed hands through illegal or disputed transactions. Properties with multiple ownership transfers in a short time should be investigated further.

9. Confirm Developer Approval (For Off-Plan Properties)

If you’re buying an off-plan property in Dubai, verify that the developer is registered with the Real Estate Regulatory Agency (RERA). Ensure that the title deed is issued only after completion and handover. Use the DLD Verification system to cross-check records.

10. Check Service Charges and Maintenance Fees

Before finalizing a deal, check if there are any unpaid service charges on the property. The Dubai Land Department (DLD) maintains a record of service charge disputes. Ensure that all dues are cleared before transferring ownership.

11. Validate Property Use Classification

In Dubai, properties are classified for residential, commercial, or mixed-use purposes. Ensure that the title deed verification confirms the property’s approved use to avoid legal issues related to zoning regulations.

12. Request a No Objection Certificate (NOC) from the Developer

If the property is in a freehold community, the seller may need to obtain an NOC from the developer before transferring ownership. Ensure this is completed before the final transaction.

13. Verify Mortgage Clearance (If Applicable)

If the property was previously financed, ensure that the mortgage is fully cleared and that the title deed is free from any financial encumbrances. Buyers should request confirmation from the Dubai Land Department (DLD) before proceeding with the purchase.

14. Conduct a Market Price Comparison

Before committing to a purchase, compare the property’s price with similar listings in the area. DLD Verification services provide market insights to help buyers determine fair pricing for properties in Dubai.

15. Use a Trusted Real Estate Agent

To minimize risks, work with a RERA-certified real estate agent who can assist in title deed verification, property inspection, and legal procedures. Avoid deals that seem too good to be true.

Conclusion

When purchasing a property for sale in Dubai, proper Title Deed Verification is a must. Use DLD Verification tools, cross-check ownership records, and consult professionals to ensure a safe transaction. By taking these precautions, you can confidently verify title deed Dubai and avoid potential fraud or legal issues.