**Dive into Financial Wellness: Unlocking Your Credit Score Potential with SharkShop**In a world where your financial health is just as crucial as your physical well-being, monitoring and boosting your credit score can feel like navigating uncharted waters.

But fear not! With every wave of information that comes crashing down, there’s an innovative tool ready to help you surf through the complexities of credit management—introducing SharkShop.biz Whether you’re aiming for that dream home, planning a big purchase, or simply looking to optimize your financial future, this powerful platform equips you with the resources and insights needed to stay on top of your credit score.

Join us as we explore how SharkShop can transform your approach to personal finance and help you ride the tide toward higher scores and greater opportunities!

Introduction to SharkShop and Credit Scores

Navigating the world of credit scores can feel like wandering through a maze. With various factors affecting your score and countless tips flooding the internet, it’s easy to get overwhelmed. Enter SharkShop.biz the ultimate tool designed to simplify your credit journey.

Whether you’re looking to buy a house, secure a loan, or just want peace of mind knowing where you stand financially, understanding and managing your credit score is essential. SharkShop not only helps you keep track but also empowers you with tools and resources that can lead to tangible improvements in your financial health. Let’s dive into how this innovative platform can transform the way you approach your credit score!

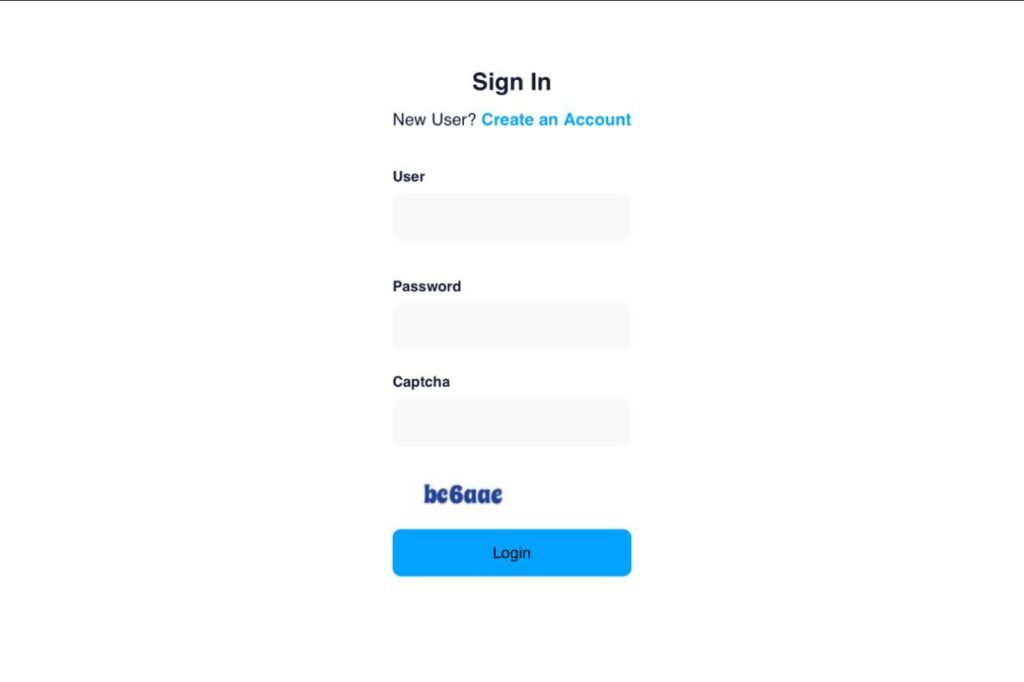

A Screenshot of Sharkshop (Sharkshop.biz) login page

The Importance of Monitoring Your Credit Score

Your credit score is more than just a number. It influences your ability to secure loans, rent an apartment, and even land certain jobs. Staying informed about this critical figure can open or close doors in your financial life.

Regularly monitoring your credit score helps you catch errors that may negatively impact it. Mistakes happen, and they can be corrected if addressed promptly.

Additionally, keeping tabs on your score allows you to notice patterns over time. Are there sudden drops? Understanding the reasons behind these fluctuations is crucial for improvement.

With identity theft on the rise, vigilance becomes essential. Monitoring alerts you to suspicious activity, enabling quick action before damage occurs.

A proactive approach empowers you with knowledge and confidence when making financial decisions. Ignoring your credit score could lead to missed opportunities or costly mistakes down the line.

How SharkShop Can Help You Stay on Top of Your Credit Score

SharkShop offers a streamlined approach to managing your credit score. With its user-friendly interface, keeping tabs on your financial health becomes effortless.

One of the standout features is real-time credit monitoring. This allows you to receive instant alerts about any changes in your credit report. Staying informed helps you act quickly against potential threats.

The platform also provides personalized insights tailored specifically for you. By analyzing your spending habits, SharkShop suggests actionable steps to boost your score effectively.

Additionally, educational resources are readily available within the app. These tools empower users with knowledge about factors affecting their scores and how to improve them over time.

With SharkShop, tracking progress feels rewarding rather than overwhelming. Regular updates keep you engaged as you work towards achieving better credit health without unnecessary stress or confusion.

– Features and Benefits of SharkShop

SharkShop offers a user-friendly interface that simplifies credit score monitoring. With real-time updates, you can track changes in your score instantly. This feature helps you understand the impact of your financial decisions as they happen.

Another standout benefit is personalized insights. SharkShop analyzes your credit profile and provides tailored recommendations to improve your score. It’s like having a financial advisor at your fingertips.

Additionally, SharkShop alerts you about significant changes or potential fraud. Staying informed means you can act quickly if something seems off.

The platform also includes educational resources on credit management, so users can learn while they monitor their scores. Knowledge is power when it comes to improving credit health!

Lastly, SharkShop integrates seamlessly with various financial accounts, giving you a holistic view of your finances all in one place. This functionality makes managing credit simpler and more efficient for everyone.

– Real Life Success Stories

Many users have experienced remarkable transformations in their credit scores thanks to SharkShop. Take Emily, for instance. After struggling with her finances, she discovered SharkShop’s user-friendly interface and jumped on board. Within months, she was able to raise her score by over 100 points.

Then there’s Marcus, who initially felt overwhelmed by his debt. With the guidance of SharkShop’s tailored tips and tools, he tackled his high credit card balances effectively. His commitment and the platform’s resources helped him achieve a significant improvement in just six months.

These stories reflect a growing trend among individuals leveraging technology to reclaim their financial health. Each success story serves as an inspiration for others looking to navigate their own challenges with credit management efficiently.

Tips for Raising Your Credit Score with the Help of SharkShop

To raise your credit score effectively, start by making timely payments on all bills. Using SharkShop login, you can set reminders for due dates, ensuring you never miss a payment.

Next, focus on reducing your credit card balances. Keeping your utilization below 30% is key. SharkShop tracks your spending habits and alerts you when you’re approaching that limit.

Building a positive payment history takes time but pays off in the long run. With SharkShop’s insights into past payments and suggestions for improvement, you’ll have the tools to establish a strong record.

Don’t forget to check your credit report regularly through SharkShop’s platform. This way, you can spot errors or discrepancies that might be dragging down your score and take action quickly.

– Paying Bills On Time

Paying your bills on time is one of the most effective ways to boost your credit score. Each payment you make contributes positively to your overall credit history. Lenders look at this when deciding whether or not to extend you credit in the future.

With SharkShop, setting up reminders can help ensure that no due date slips past you. The app sends alerts directly to your phone, keeping you informed and proactive about upcoming payments.

Make it a habit to pay on or before the due date. Even small delays can lead to late fees and negatively impact your score over time. By consistently staying ahead of your bills, you’re building a solid foundation for financial health.

Additionally, timely payments demonstrate reliability. This factor plays a crucial role during loan applications where lenders assess risk based on historical behavior. Embracing punctuality with bill payments can pave the way for better opportunities down the road.

– Reducing Credit Card Balances

Reducing credit card balances is a powerful strategy for boosting your score. High utilization ratios can drag down even the best scores. Aim to keep your usage below 30% of your total credit limit.

Start by making more than just the minimum payments each month. This approach not only accelerates debt reduction but also shows lenders you’re serious about managing your finances.

Consider consolidating higher-interest debts into one lower-interest option, if feasible. It simplifies payments and can save money on interest in the long run.

Another effective tactic is to focus on paying off cards with the highest balances first while maintaining minimum payments on others. This method reduces overall debt quicker and increases financial confidence as you see progress.

Lastly, avoid accumulating more debt during this process. Resist impulse purchases that could add weight back onto those balances and jeopardize all your hard work.

– Building a Positive Payment History

Building a positive payment history is crucial for your credit score. It reflects how reliable you are in meeting your financial obligations.

One effective way to enhance this aspect is by making timely payments on all bills. This includes loans, utilities, and even subscriptions. Each punctual payment adds to the narrative of responsibility.

Additionally, consider setting up automatic payments or reminders through SharkShop. This can help ensure you never miss a due date again.

Another tip is to diversify your credit types. Having various accounts—like installment loans and revolving credit—can showcase your ability to manage different forms of debt responsibly.

Lastly, stay engaged with SharkShop cc insights and notifications about upcoming due dates or changes in your accounts. Being proactive leads not only to improvements in scores but also builds long-term trustworthiness with creditors.

Additional Resources for Improving Your Credit Score

Improving your credit score is a journey, and various resources can guide you along the way. Consider visiting reputable websites that offer free financial education articles and tools. These platforms often provide insights into credit management strategies.

Podcasts focusing on personal finance are another excellent resource. They feature expert interviews discussing tips for enhancing your creditworthiness while sharing real-life experiences of individuals who have transformed their scores.

Additionally, local community organizations frequently host workshops on budgeting and credit repair. Participating in these sessions can help you gain valuable knowledge from professionals dedicated to improving financial literacy.

Finally, consider utilizing forums or social media groups focused on credit improvement. Engaging with others allows you to share tips, ask questions, and find support as you work towards elevating your credit standing.

Conclusion: Why SharkShop is the Ultimate Tool for Managing and Improving Your Credit

SharkShop.biz stands out as an essential tool for anyone looking to manage and improve their credit score. With its user-friendly interface and powerful features, it simplifies the process of tracking your financial health. The platform not only provides real-time updates on your credit score but also offers personalized tips tailored to your unique situation.

By leveraging SharkShop’s resources, you can take significant steps towards enhancing your credit profile. From monitoring changes in your score to receiving alerts about potential issues, this tool keeps you informed every step of the way. Plus, with a wealth of success stories from satisfied users who have transformed their credit standings thanks to SharkShop’s guidance, it’s clear that this platform makes a difference.

Whether you’re aiming to buy a home or secure a better interest rate on loans, understanding and improving your credit is crucial. SharkShop equips you with everything needed for effective management—making it easier than ever before to achieve those financial goals. Embracing what SharkShop has to offer could be one of the best decisions for securing a brighter financial future.